Miti: Govt plans investment ‘scorecard’ focusing on ESG, job creation and economic complexity to evaluate investments, drive high-value growth

KUALA LUMPUR, Oct 15 — The government is looking at having a clear scorecard focused on high-quality investments and incentives to align with the National Investment Aspirations (NIA) and New Industrial Master Plan (NIMP), said the Investment, Trade and Industry Ministry (MITI).

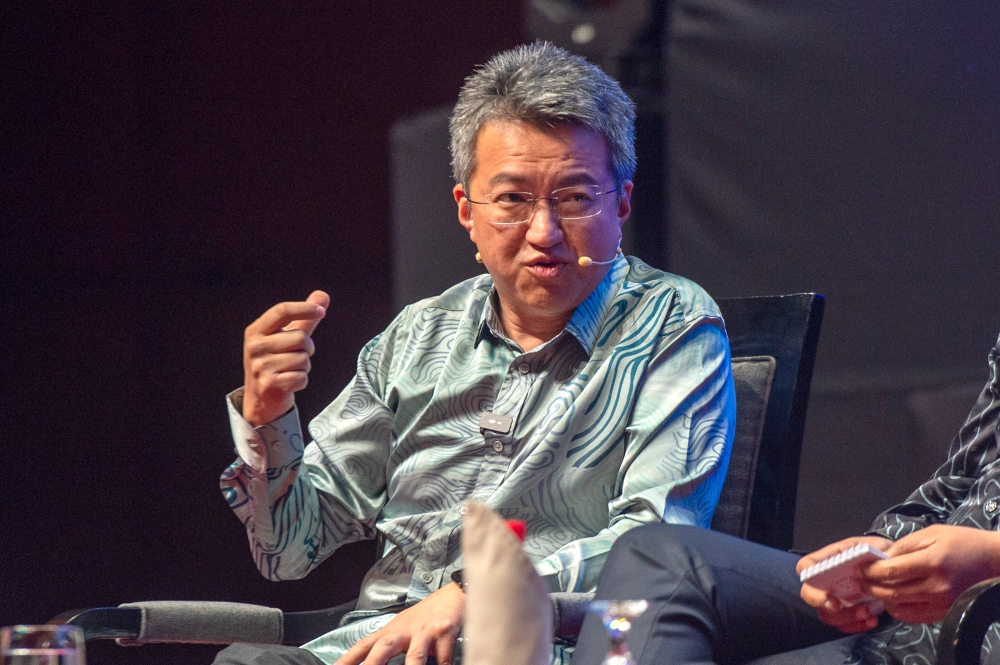

Its Deputy Minister Liew Chin Tong said this effort requires collaboration with agencies including Bank Negara Malaysia, the Securities Commission, MITI, and the Finance Ministry (MOF).

“Companies we incentivise will have to explain to the government its contribution to Malaysia’s innovation and technology.

“Whatever we do today we must build Malaysia’s research and development (R&D). We must build Malaysian technological capability,” he said in his keynote speech at the SC-World Bank Conference 2024 today.

He said the measure of high-quality investments involves several pillars of the NIA, namely, increasing economic complexity, creating high-value job opportunities, extending domestic linkages, developing new and existing economic clusters, and improving inclusivity and environmental, social, and governance (ESG) standards.

Meanwhile, the conference explores synergies within the capital and the Islamic capital market to bridge funding gaps for micro, small and medium entrepreneurs (MSMEs) and mid-tier companies (MTCs).

At the event, the SC and the World Bank launched a joint report “ESG Disclosure Assessment of Malaysia’s Listed Companies and Recommendations for Policy Development” which provides a baseline on ESG reporting practice in Malaysia. The report offers insights for companies and investors to enhance sustainability reporting to align with international best practices and remain competitive.

It aims to analyse the current state of ESG disclosure among listed companies and institutional investors, given the growing prominence of ESG and sustainability investments globally.

It also provides reflections and recommendations for policymakers in the Malaysian capital market to foster improved ESG reporting, ensuring relevance and consistency globally.

SC executive director of Islamic Capital Market Sharifatul Hanizah Said Ali emphasised the importance of strengthening ESG disclosures amid growing global demand for sustainable investments.

“This joint report reflects our ongoing commitment to fostering a more sustainable capital market. Improved ESG disclosure practices are expected to strengthen investor confidence and ensure that our market remains competitive and future-ready,” she said in her welcoming remarks.

The report highlights that most Malaysian listed companies had demonstrated good corporate disclosures and a solid overall approach to managing governance and social issues.

However, the report also points out gaps in specific environmental indicators, especially those related to climate change and biodiversity.

“Through our knowledge-based collaboration, we aim to support effective policy design and implementation to address the MSME and climate financing gaps.

“I look forward to further leveraging the World Bank’s global expertise to support the Malaysian government, financial regulators, and the private sector in developing a more robust and resilient financing ecosystem for MSMEs,” said World Bank country director for the Philippines, Malaysia, and Brunei Dr Zafer Mustafaoglu. — Bernama