SASB Standards Unveiled: A Deep Dive into Industry-Specific ESG Materiality

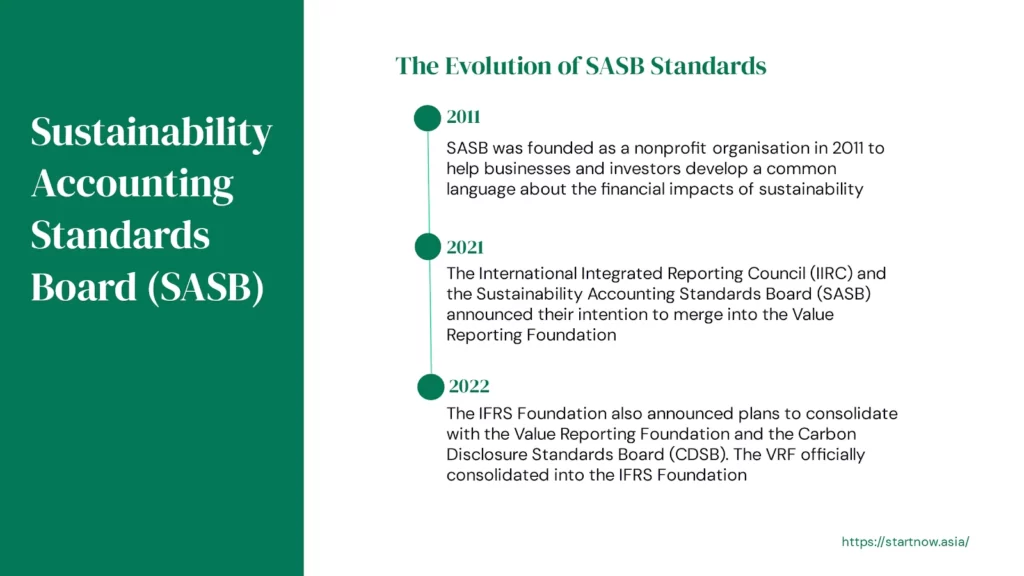

The Sustainability Accounting Standards Board (SASB) is an independent non-profit, whose mission is to develop and disseminate sustainability accounting standards that help public corporations disclose material, decision-useful information to investors.

SASB’s standard-setting process is designed to surface the sustainability factors most likely to materially impact the financial condition or operating performance of companies in a given industry.

A company can begin this process by familiarizing itself with SASB terminology and the structure of SASB Standards, which can be downloaded free of charge. In reviewing SASB Standards, a company should familiarize itself with the following components:

- Standards Application Guidance: In reviewing its industry standard(s), a company should begin with this supplementary document, which provides universal implementation guidance applicable to all industry standards. Please note: entities using the SASB Standards as part of their implementation of ISSB Standards should consider the relevant ISSB application guidance.

- Disclosure topics: Each SASB Standard includes a set of disclosure topics, which vary from industry to industry. The standard lists and briefly describes how management or mismanagement of various aspects of the topic may impact a company’s ability to create long-term value. On average, SASB Standards include 6 disclosure topics per industry.

- Metrics: Each SASB Standard provides companies with standardised quantitative—or, in some cases, qualitative—metrics intended to measure performance on each disclosure topic or an aspect of the topic. On average, SASB Standards include 13 metrics per industry.

- Technical protocols: Each sustainability metric is accompanied by underlying technical protocols that provide guidance on definitions, scope, accounting, compilation, and presentation, and which may also serve as the basis for suitable criteria for an independent, third-party assurance engagement. The technical protocols help ensure that metrics are compiled consistently and enable comparisons across companies.

- Activity metrics: The standard also includes activity metrics to measure the scale of the issuer’s business, providing operational context and facilitating normalisation of SASB metrics, which is important for the analysis of related disclosures.